Today, states are trying to be more open to foreign trade. Regional alliances are formed where customs barriers are kept to a minimum, and the World Trade Organization, which consists of 164 countries, obliges the authorities to lower the rates of customs duties. Today, many states are moving away from the fact that customs duties were for them the main source of budget replenishment, since this significantly hinders the development of trade relations.

However, there are other countries, for which the levying of foreign goods is almost the main source of funds for the state treasury. They are motivated by this, as a rule, by protectionist policies - protection of the domestic market and the domestic producer.

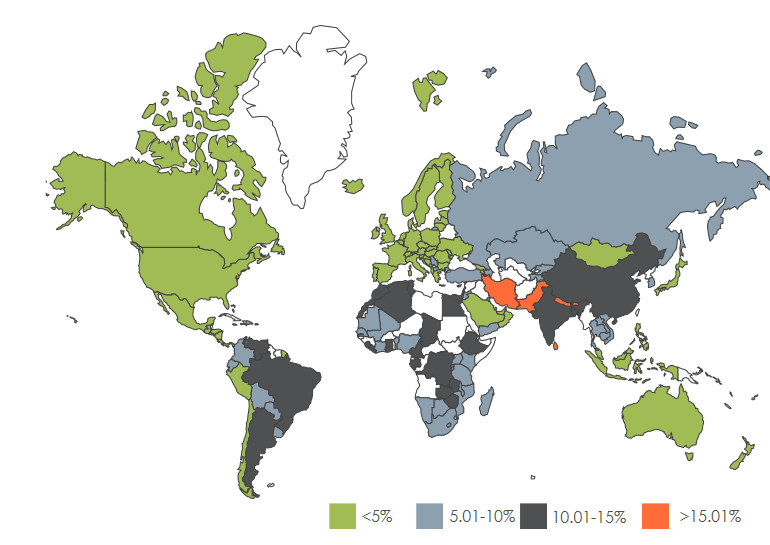

The World Economic Forum published a report Global Competitiveness Report 2016-2017, which assessed the competitiveness of 138 economies of the world. The authors analyzed the countries on the basis of statistical data and the results of a survey of business representatives. Among the indicators that affect the final ranking of the country in the rating, such as "Macroeconomic stability", "Labor market efficiency", "Higher education and vocational training" is a group of indicators directly related to competitiveness in foreign trade. Among them, the most interesting assessment of the level of trade tariffs - i.e. Average rate of duties on goods. The authors of the study note that this indicator is calculated as a weighted average amount of fees, which is levied on imports of goods taking into account all the benefits and preferences granted to other countries, as well as the structure and volume of trade of this state.

As the research data show, fences from the rest of the world are fenced off mainly by developing and least developed countries, while other states reduce duties and pass to non-tariff measures to protect the market.

Zero indicators for average duty rates for several consecutive years show Hong Kong and Singapore - free economic zones, into which almost all products are duty-free. Exceptions are only a few groups, including oil products, tobacco products and spirits. In addition, the European Union countries also set the minimum values - the average customs duty rates decreased from 1.2% to 1% in comparison with the previous year.

In general, according to the results of the study, weighted average rates fell from 66 states, and 45 countries, on the contrary, increased. However, for the whole world, the median value of the rate was higher - according to the results of the previous study it was 5.88%, and in 2016 - 6.47%.

Where else are excessively high duties applied

Even if the average tariffs for a customs tariff in a particular state are not so high, they can often find really predatory rates on the importation of certain types of goods. Sometimes the state really wants to protect its producer in this way, but more often to replenish the treasury.

So, for example, in some African countries simply exorbitant rates of duties for the taxation of luxury goods, which include jewelry, watches, delicacies, are used. Sometimes they include tobacco products and alcohol. In Tanzania, maximum rates have recently reached 100-200%, in Sudan - 600%, and in Somalia - 736%. Under this rate, alcoholic beverages were found. Record high duties are often imposed and imports of cars - for example, the Iranian authorities to protect domestic manufacturers introduced a rate of 90% of the cost of cars.

A record increase in duties at the end of 2016 was reported by the Egyptian authorities. The increase will affect immediately 320 types of goods. According to the Ministry of Finance of the country, this will reduce the foreign trade deficit, activate the producers and will bring to the treasury to $ 339 billion annually. The duties themselves will grow by 40-60%, while the increase will include food, perfumes, furniture and other products. The duty on carpets will double from 30% to 60%. Thus, the country is trying to restore the economy after coups d'état.